Hyperproof for Fintech: Automate GRC Workflows and Save Hours of Time

Understand your gaps to FINRA and keep up with regulatory changes while reducing your workload around evidence collection and audit preparation, all with Hyperproof.

- 100+ pre-built templates for FFIEC, GLBA, PCI DSS, NIST CSF, CCPA, SOC 2, and many more

- Over 70 integrations, including ServiceNow, Asana, Jira, Slack, and Teams

- Out-of-the-box risk register capabilities to link risks to controls

- Automated evidence collection, control testing, and task management tools

We engineer trust for fintech and financial services companies like:

Top Ranked Industry Leader

See Hyperproof in Action

Trusted By

Meet compliance requirements for your fintech company with Hyperproof

Automate evidence collection and label creation

Automate evidence collection and link evidence to requirements and controls. Generate labels, them to proof, and automatically refresh evidence in real-time or on a regular cadence.

Automate control testing and map controls across frameworks

Map existing controls to other frameworks like those provided by the FFIEC, NIST CSF, NIST 800-53, SOC 2, PCI DSS, GLBA, CCPA, ISO 27001, and GDPR. Automatically test and monitor control effectiveness and auto-create tasks based on test status.

Manage, track, and report on risks

Collect and track your risks in Hyperproof’s risk register and get the real-time reports and dashboards you need to answer questions from stakeholders and understand your compliance posture.

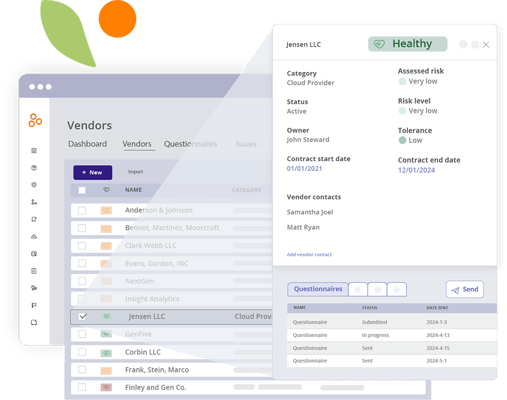

Maintain a central source of truth for vendor risk

Assess vendor risk profiles with automated assessments. Efficiently conduct vendor due diligence, contract reviews, and vendor risk remediation activities in one place.

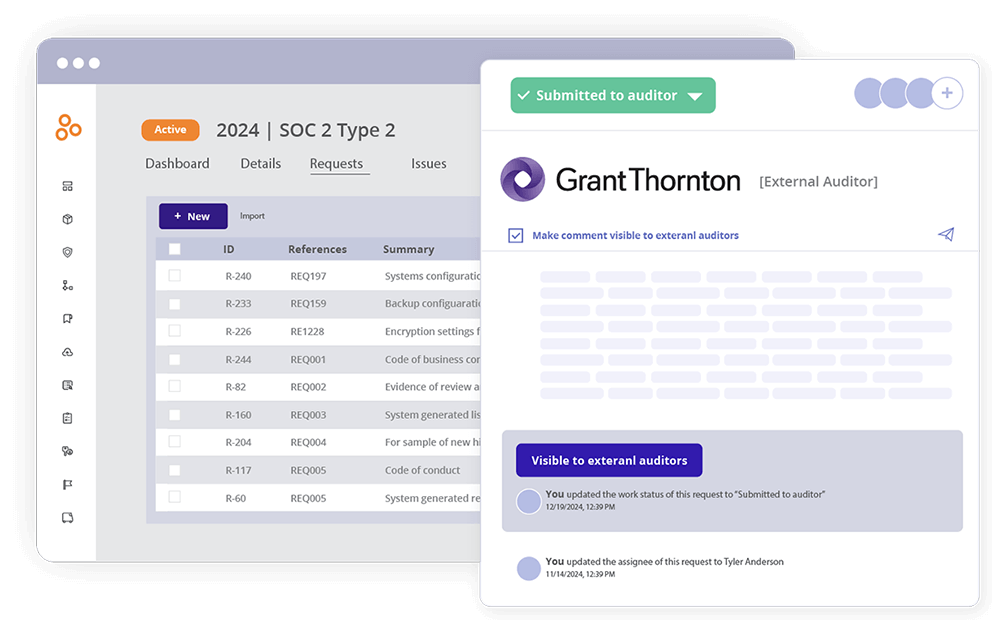

Work alongside your auditor in one place

Invite your auditor to work alongside your team in Hyperproof’s dedicated audit space to make information sharing easy while ensuring they only have access to what they need.

“Hyperproof was so easy to implement. It doesn’t have complex workflows and it has a simple UI. Best of all, we can configure it to meet our business needs.”

Narendra Dunna

Director of the Cybersecurity Assurance Program

Success Metrics

Unlock Real ROI with Hyperproof

Increase productivity for security and compliance teams by 70%

Save over 1,000+ hours of time managing compliance frameworks

Reduce manual compliance work for business stakeholders by 2/3

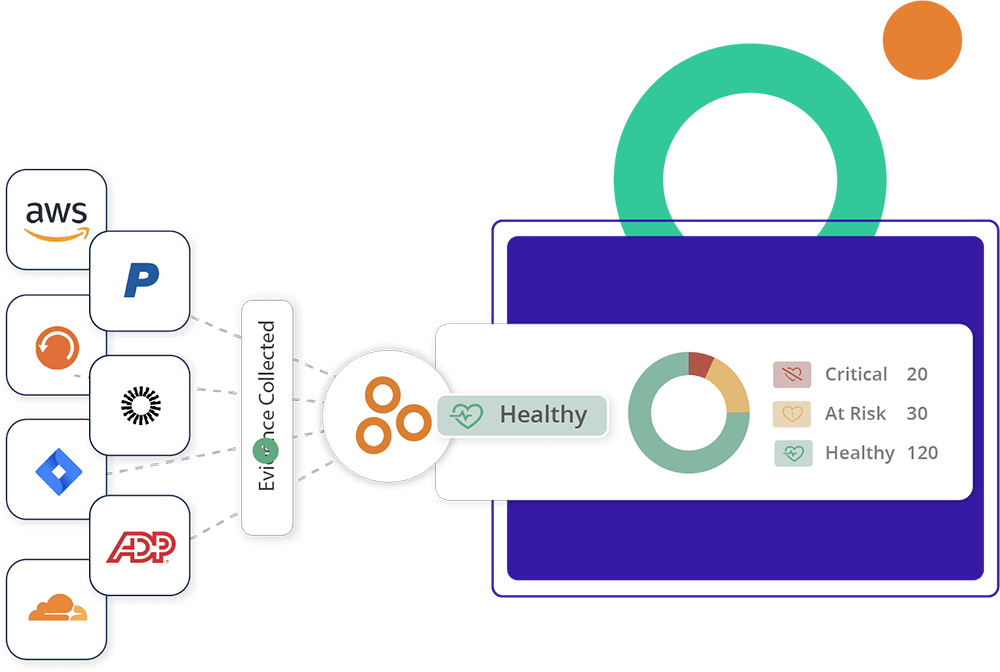

Save your team hours of work with Hypersyncs

Hypersyncs automate manual evidence collection for many popular platforms to help your compliance team save hours of time.

The largest framework library on the market

Hyperproof makes it possible to streamline evidence collection, collaboration, and workflow processes when it comes to managing these frameworks, and many more.

Integrate Your FinTech Compliance and Risk Management

See firsthand how Hyperproof can increase your efficiency by streamlining and automating your compliance and risk operations to better ensure your adherence to complex financial services regulations.

.png?width=165&height=66&name=avaneer_white%20(1).png)

.png?width=165&height=66&name=mizuho_white%20(1).png)

.png?width=165&height=66&name=solventum_white%20(1).png)